The new presidency in the United States and the tumultuous geopolitics in the Middle East are key issues in the strategic analysis of the 2025 scenario

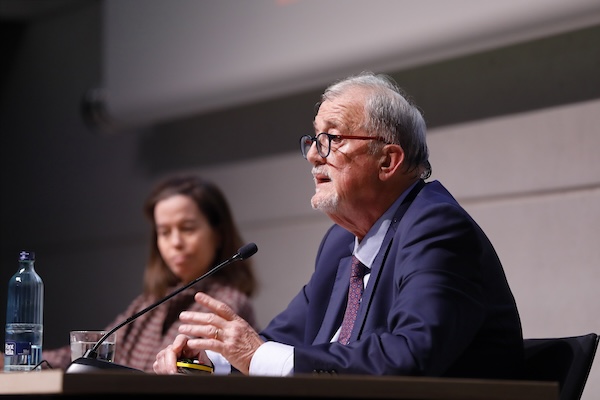

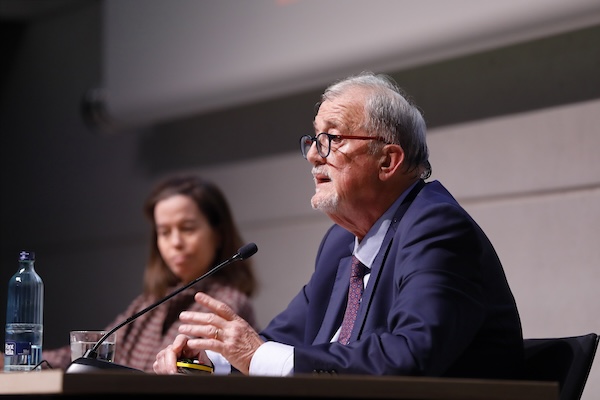

In the Esade Alumni Refresher Program session entitled “Economic and Financial Outlook for 2025,” Economics professor F. Xavier Mena offered a detailed analysis of the economic outlooks for different regions. Mena reminded the audience how traditional economics principles viewed globalization as positive, but the impact of Donald Trump’s policies could radically change the global economic scene. “The principles that used to prevail in the economic world viewed globalization as positive, but Donald Trump, at that time a real-estate mogul, published in U.S. newspapers a thesis totally opposite to the one he presented in the 2016 elections, with which he has now won the 2024 elections with the majority of votes,” he said at the beginning of the session. He added that, “starting on January 20, 2025, in the White House Oval Office President Trump will not even wait a single day before he begins to sign executive orders that are going to make the world take a 180-degree turn. To some people this is terrifying, while for others it promises exciting years.”

From multilateralism to "decoupling"

Professor Mena began the session by analyzing Trump’s actions during his first term of office, when he sought to balance trade exchanges and promote their reciprocity. “To Trump, this reciprocity is leading to a transfer of income and wealth from the citizens of the United States to the rest of the world, especially to certain countries like China, Vietnam, Germany, Ireland, Canada, and Mexico.”

But the United States’s fiercest rival is China due to the competitive advantage of its salaries, the exchange rate, its intellectual property and tech transfer policies, and its pollution management, and this is why Trump declared a trade war against China during his first term, imposing tariffs on Chinese imports valued at 200 billion dollars. “There is no dispute on this position between Democrats and Republicans, and therefore it’s a state policy,” Mena said. But during that period, Covid-19 emerged and the agreements with China were never carried out. Now it is likely that the United States is going to resume those agreements where they left them off, and China will cease being the United States’s main exporter.

China, in turn, still has a competitive advantage in the energy transition (as the leading importer and processor of raw materials) and the electric car market, even though it is facing adjustments due to its quick growth. Mena also stressed that Donald Trump is very likely to carry on the war over tech leadership started by the Biden administration.

Regarding the U.S. stock market, Mena warned about possible adjustments due to its extreme growth. Plus, even though the Federal Reserve has managed to curtail inflation, Trump’s policies may be inflationary in the long term and may lead to excessive deregulation. In immigration, Trump has promised to deport 11 million illegal immigrants and restrict the entry of citizens from certain countries. And with regard to monetary policy, he is trying to make the dollar the benchmark global currency.

Thus, the multilateralism fostered by the United States after World War II is being replaced by a new international economic architecture. In professor Mena’s opinion, the keyword in 2025 will be “decoupling,” with the United States leading a world that is economically bipolar and fragmented. “Decoupling is the word you’re going to here from now on: we have to decouple from China, and Europe will do it because the United States is trying to get us to do everything.”

The outlook in Europe and Spain

Finally, Mena analyzed the situation in Europe and Spain by stating that Trump does not understand how the European Union works, and that the EU is facing an existential crisis with the rise in anti-EU populism. Plus, Europe has to lower its public debt in order to compete with a deregulated United States.

In Spain, the economy is doing well after its post-COVID recovery, with inflation controlled and the job market on the upswing. However, the long-term prospects are not optimistic due to the lack of structural reforms. “Internally, we have seven years to lower our debt and public deficit, but the years keep flying by and the reforms we are enacting are leading in the opposite direction, so the coming years are going to be a labyrinth,” he said.

F. Xavier Mena concluded that the Trump administration may lead the global economy to the verge of the precipice, and he also noted that vice-president J.D. Vance may well continue these policies in the future.

Video of the Barcelona session (December 2024)

Video of the Madrid session (January 2025)